Pradhan Mantri Rojgar Yojana 2025 : Government Offering Loans to Start Your Own Business Know the Application Process

Hello Friends, how are you all? Welcome to today’s special article. If you are someone who dreams of starting their own business but lacks the necessary funds, then the Government of India has brought a golden opportunity for you. In 2025, the Pradhan Mantri Rojgar Yojana is once again in action to support individuals in setting up their own ventures with financial help through easy loan facilities.

This scheme is aimed at empowering unemployed youth and aspiring entrepreneurs by helping them stand on their feet. If you are planning to take a step towards self-reliance and want to become financially independent, then this article is going to be very helpful for you. Let’s explore all the details step by step so you don’t miss any important update.

What Is Pradhan Mantri Rojgar Yojana 2025?

Pradhan Mantri Rojgar Yojana 2025 is a flagship scheme of the Government of India designed to provide financial assistance to unemployed individuals who want to start their own business. It provides a loan facility at subsidized interest rates through various banks and financial institutions.

The scheme primarily targets educated youth from rural and urban areas who are willing to initiate micro-enterprises or small-scale businesses. Under this scheme, beneficiaries can get loans up to a certain limit without the need for heavy collateral or complex paperwork, making it easier for first-time entrepreneurs.

Who Can Apply For This Scheme?

To ensure the right people benefit from the scheme, the government has set specific eligibility criteria. These criteria are aimed at helping those who truly need financial support for entrepreneurship.

The basic requirements include age limit, educational qualifications, and the nature of the business. Priority is given to individuals from economically weaker sections, women entrepreneurs, and those belonging to backward areas.

Pradhan Mantri Rojgar Yojana 2025 Key Highlights

Below is a quick summary of all major points related to the scheme. This table will help you understand everything at a glance:

| Details | Information |

|---|---|

| Article Name | Pradhan Mantri Rojgar Yojana 2025 |

| Objective | Self-employment through easy business loans |

| Beneficiaries | Unemployed youth and aspiring entrepreneurs |

| Loan Limit | Up to Rs. 10 Lakhs |

| Interest Subsidy | Up to 15% or as per bank rules |

| Required Documents | ID, Address Proof, Business Plan, etc. |

| Official Website | www.pmyojana.gov.in |

How Much Loan Can Be Availed?

Under this scheme, the government allows you to avail loans up to Rs. 10 lakhs, depending on the nature of the business and your capability to repay. The interest rates are either low or partially subsidized, which means the burden on the borrower is less.

This loan can be used for purchasing machinery, setting up the unit, or any other related business expenditure. In most cases, repayment starts after a grace period of 6 to 12 months, giving the entrepreneur some breathing room.

Eligibility Criteria To Apply For PMRY 2025

Before applying, it is crucial to check if you are eligible under the new rules laid out for the 2025 version of the scheme. The updated criteria have been made more inclusive and business-friendly.

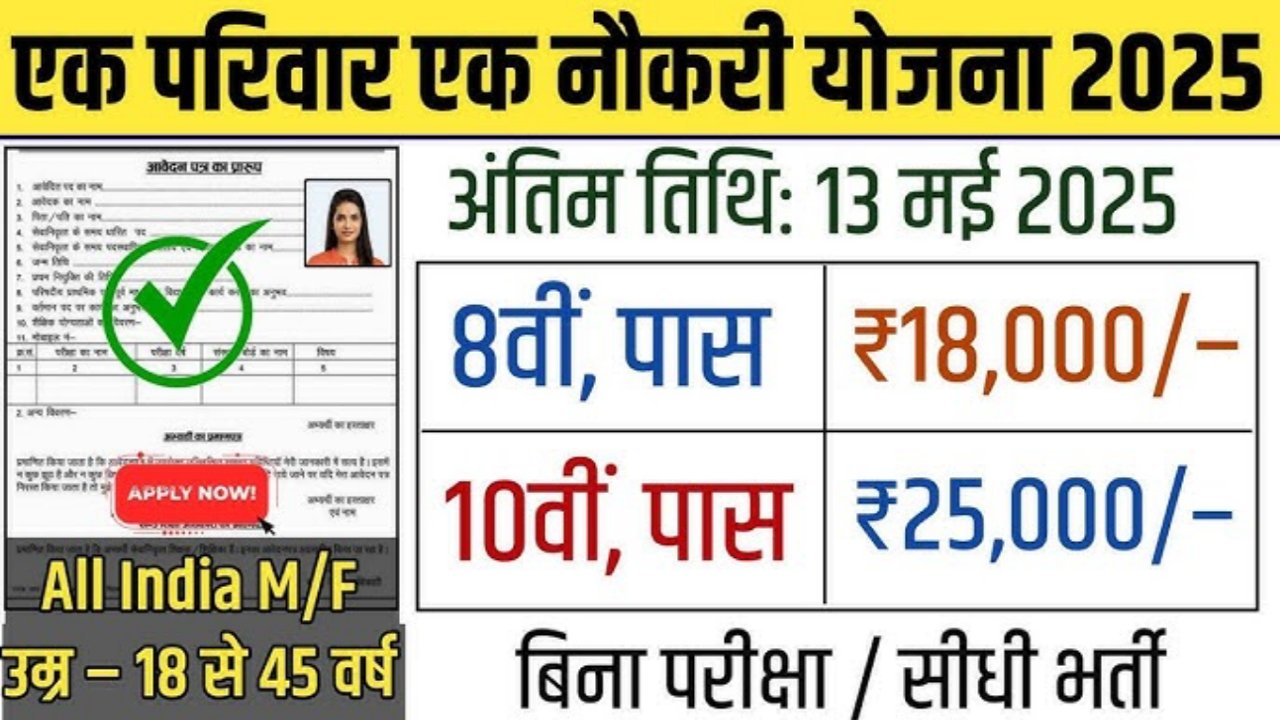

- Applicant must be between 18 to 40 years old.

- Should have passed at least 8th standard.

- Should not be a defaulter in any bank.

- Preference given to SC/ST/OBC/Women and ex-servicemen.

Required Documents For Application

While submitting the application, a few important documents are necessary to verify the identity and the feasibility of the proposed business model. These documents must be submitted to the respective banks or government portals.

- Aadhaar Card and PAN Card

- Address Proof

- Educational Certificates

- Business Plan and Cost Estimation

- Caste Certificate (if applicable)

Step-By-Step Application Process For PMRY 2025

The government has made the application process for Pradhan Mantri Rojgar Yojana 2025 very smooth and hassle-free. Most steps can be completed online or through your nearest bank branch.

First, the applicant needs to register on the official website. After successful registration, they need to submit documents, attend an interview or training session, and finally get the loan disbursed after approval.

How To Register On The PMRY Portal?

Once you visit the official website, you will see a tab named “Apply Now.” Click on it and fill in the personal and business details. It is essential to upload the required documents in the right format to avoid rejection.

After submission, you will receive an application ID which will help you track the status of your application. Make sure all details are accurate and honest to improve your chances.

Loan Repayment And Benefits Of PMRY Scheme

One of the significant advantages of this scheme is the flexible repayment options. You don’t have to start paying immediately; a grace period is offered. Additionally, if your business performs well, you can also apply for loan extensions or further assistance.

The interest subsidy provided by the government reduces the overall financial burden, and the simplified process encourages more people to take a step towards self-employment.

FAQs

- What is the maximum loan limit under PMRY 2025?

- The loan limit is up to Rs. 10 lakhs based on your business plan.

- Is any training provided before disbursing the loan?

- Yes, training sessions are mandatory to ensure business understanding.

- Can women entrepreneurs apply under this scheme?

- Yes, women are given special preference and relaxation in norms.

- Is collateral required for the loan?

- For smaller loan amounts, collateral may not be needed.

- Where can I apply for PMRY 2025?

- You can apply through the official website: www.pmyojana.gov.in

Conclusion

Pradhan Mantri Rojgar Yojana 2025 is a strong initiative to reduce unemployment and promote entrepreneurship across India. If you are serious about starting your business, this scheme can be the right path to turn your dreams into reality.

Feedback Section: Do share your thoughts or questions in the comments below and let us know how helpful this article was.

Disclaimer: This article is for informational purposes only. Please verify details from the official website before applying.

Post Comment